narxoz.ru

Prices

Can I Borrow Against My 401k To Buy A House

4. Under what circumstances can a loan be taken from a qualified plan? A qualified plan may, but is not required to provide for loans. If a plan provides for. Taking a loan from your (k) does not trigger a taxable event and you are not hit with the 10% early withdrawal penalty for being under the age of (k). K loans are generally limited to 50% of the balance. So at best you're looking at getting $30K total, $15K from each K. You'd be much. Yes, you can use your k to buy a house so long as the holder of your account allows you to withdraw or take a loan from said account. Major purchases or expenses: A HELOC can be a great way to fund a major purchase or cover a large expense. Even if you don't have an immediate cash need. Because the money needed for a down payment is not always easy to come by, lenders of all types allow borrowers to apply money from a K loan. Depending on what your employer's plan allows, you could take out as much as 50% of your vested account balance or $50,, whichever is less. An exception to. If you take out a (k) loan, you generally cannot add more money to your (k) while the loan is unpaid. That means you could miss out on the chance to add. In most circumstances, $50, is the maximum you can borrow from a (k). purchase or sale of any security or investment strategy. Merrill offers a. 4. Under what circumstances can a loan be taken from a qualified plan? A qualified plan may, but is not required to provide for loans. If a plan provides for. Taking a loan from your (k) does not trigger a taxable event and you are not hit with the 10% early withdrawal penalty for being under the age of (k). K loans are generally limited to 50% of the balance. So at best you're looking at getting $30K total, $15K from each K. You'd be much. Yes, you can use your k to buy a house so long as the holder of your account allows you to withdraw or take a loan from said account. Major purchases or expenses: A HELOC can be a great way to fund a major purchase or cover a large expense. Even if you don't have an immediate cash need. Because the money needed for a down payment is not always easy to come by, lenders of all types allow borrowers to apply money from a K loan. Depending on what your employer's plan allows, you could take out as much as 50% of your vested account balance or $50,, whichever is less. An exception to. If you take out a (k) loan, you generally cannot add more money to your (k) while the loan is unpaid. That means you could miss out on the chance to add. In most circumstances, $50, is the maximum you can borrow from a (k). purchase or sale of any security or investment strategy. Merrill offers a.

Taking a loan from your (k) does not trigger a taxable event and you are not hit with the 10% early withdrawal penalty for being under the age of (k). Taking a loan from your (k) does not trigger a taxable event and you are not hit with the 10% early withdrawal penalty for being under the age of (k). More In Retirement Plans Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan. Many borrowers use money from their (k) to pay off credit cards, car loans and other high-interest consumer loans. On paper, this is a good decision. The The funds in your (k) retirement plan can be tapped for a down payment for a home. You can either withdraw or borrow money from your (k). k Loan for Home Purchase. One way to use (k) funds for a home purchase is through a process called a “k loan.” This allows you to borrow money from. You can borrow money from your retirement plan and pay the funds back with lower interest rates than other types of borrowing, such as a credit card. Borrowing from your (k) may help cover your required % down payment for an FHA loan or 20% down payment for a conventional loan, meaning you can avoid. Borrowing from a retirement plan to fund a down payment is becoming increasingly popular. It can be a great tool, but you need to be aware of the risks. First. k Loan for Home Purchase. One way to use (k) funds for a home purchase is through a process called a “k loan.” This allows you to borrow money from. Borrowing from a retirement plan to fund a down payment is becoming increasingly popular. It can be a great tool, but you need to be aware of the risks. First. You will then have up to five years to repay whatever you borrowed plus interest. You may be thinking, 'It's my money. Why do I have to borrow it?' Since a More In Retirement Plans Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan. You may be able to borrow against your k for the purpose of a home purchase down payment. Read the guidelines of your k to see if this is. Using (k) funds to purchase a home: The second way to use your (k) funds to buy a house is to take out a loan from your plan. You do not have to pay the. Before borrowing, figure out if you can comfortably pay back the loan. The maximum term of a (k) loan is five years unless you're borrowing to buy a home, in. You can borrow from a k or IRA to buy a house, but your employer needs to approve the borrow. Watch for amount limits and borrowing time. A (k) loan allows you to borrow from the balance you've built up in your retirement account. Generally, if allowed by the plan, you may borrow up to 50%. Yes, early withdrawals from your (k) are possible, but they generally incur a 10% penalty and are subject to income tax. Can I borrow against my k? Yes. Your employer will have to approve the loan, but they are not required to do so. If you are allowed to borrow from your (k), you can borrow half of the.

Get A 15000 Loan

Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. Top 5 Lenders For $15, Loans for Bad Credit · Prestamos: Specialises in offering $15, loans to individuals with poor credit, featuring. I got a 15k personal loan through a vendor on credit karma recently. It was very easy and fast, like 4 days from applying to funding. Borrow £ Loans from LoanTube. LoanTube offers unsecured personal loans from £ to £ You can borrow a loan depending on your creditworthiness and. To avail instant urgent loan , there are certain eligibility criteria that you need to meet. Firstly, your age should be between years old. Secondly. $15,, 3, %, %, $, $ $15,, 5, Pros and cons of no-collateral loans; How to get an unsecured loan; How to get low interest rates. These fees can get as high as % of your loan amount and are typically How much would a $15, loan cost per month? The monthly payment amount. Rate? Checked. Credit Score? Untouched. Get a fixed-rate loan up to $50, for almost anything this summer—and. Infographic: If your total loan amount is $15,, Excellent credit would get you a. How to get your credit report and credit score. You can request your. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. Top 5 Lenders For $15, Loans for Bad Credit · Prestamos: Specialises in offering $15, loans to individuals with poor credit, featuring. I got a 15k personal loan through a vendor on credit karma recently. It was very easy and fast, like 4 days from applying to funding. Borrow £ Loans from LoanTube. LoanTube offers unsecured personal loans from £ to £ You can borrow a loan depending on your creditworthiness and. To avail instant urgent loan , there are certain eligibility criteria that you need to meet. Firstly, your age should be between years old. Secondly. $15,, 3, %, %, $, $ $15,, 5, Pros and cons of no-collateral loans; How to get an unsecured loan; How to get low interest rates. These fees can get as high as % of your loan amount and are typically How much would a $15, loan cost per month? The monthly payment amount. Rate? Checked. Credit Score? Untouched. Get a fixed-rate loan up to $50, for almost anything this summer—and. Infographic: If your total loan amount is $15,, Excellent credit would get you a. How to get your credit report and credit score. You can request your.

We can help you get the $15, you need without any hidden fees. We offer unsecured loans with low interest rates and flexible repayment terms. Find out how. A £ personal loan could help you consolidate your debts or fund home improvements. Apply online for a £ loan via My Community Finance. A ₹ personal loan is a great way to fulfil your monetary needs. You can activate your Zype credit line in less than 8 minutes with basic details and. There are many options open to you when it comes to loans of this size, each with their own benefits and uses. The hard part is deciding who and where to get it. You may need good credit and sufficient income to qualify for a $15, personal loan. A $15, loan from a bank, credit union, or private lender can help. Borrow up to $15, Get a loan that works for you and your budget, with up to $15, in available loans, without collateral. No prepayment penalties. No. If you, like Sue and Jack, have heard of personal loans but find yourself searching "how to get a personal loan from a bank," you're not alone. What is an. Let's say you have a FICO credit score and you want to take out a $15, loan with a three-year term. Find your estimated rate in the chart above. Then. This will depend on your circumstances, but assuming you have an excellent credit score, you should qualify for a market-leading loan rate. Loan Repayment. Will my credit get checked when I apply for a personal loan? Yes. As with Financing for month terms requires financed amount of $15, or greater and. Apply for a personal loan without ever leaving your couch. U.S. Bank customers could receive funds within hours. Check your rate & apply. To be eligible for a personal loan, you are required to have an open Wells Fargo account for at least 12 months. Get an estimate of monthly payments for a. For example, if you get approved for a $15, loan at % APR for a term of 72 months, you'll pay just $ per month. You must have a minimum individual or. Excellent credit and up to a three-year term are required to qualify for lowest rates. Monthly payments for a $15, loan at % with a term of three years. What type of loan can I get? · loan Icon. Unsecured personal loans ; Why compare £ loans with MoneySuperMarket · We'll search the market ; With a pre-approved. A Personal Unsecured Installment Loan from PNC provides you access to the money you need without requiring collateral. Apply for an unsecured personal loan. Your payment is made by monthly direct debit from the account the loan is paid into. Your first payment will be made one month after issue of the loan on the. Looking for a loan? With Asda Money, you could borrow as much as £ from a trusted panel of lenders. Check your eligibility without harming your credit. With a Personal Loan from Regions, borrow money to cover major expenses, consolidate debt, fund large purchases and more. Apply for a loan today. Take this quiz to see if you're up to date on your personal finance knowledge. Take the financial IQ quiz. Get answers.

Best Rated Motorcycle Insurance

Motorcycle insurance can help protect you and your motorcycle. Get a fast and free motorcycle insurance quote to explore your options with Allstate. Start saving with VOOM's usage based insurance. by switching to VOOM Insurance, Rideshare, Delivery drivers and motorcycle riders can save up to 60%. Best Motorcycle Insurance of ; Best Overall: Progressive ; Best for Daily Commuters: Geico ; Best for Motorcycle Collectors: Foremost ; Best for Custom Bike. reviews. We only partner with the top-rated motorcycle insurance companies in California to ensure that you get the best coverage options and at the lowest. best motorcycle insurance or the cheapest motorcycle insurance. We've put Compare Quotes From Top-Rated Insurance Companies. Zip Code Please enter a. 1 Answer Insurance · · 1, reviews ; Devitt · · 24, reviews ; Bennetts · · 13, reviews ; Wiserchoice · · reviews. Motorcycle Insurance in Mountain View, CA ; Nationwide Insurance. out of 5 rating3, Reviews ; Farmers Insurance. out of 5 rating1, Reviews ; State. Farmers is the smart choice for motorcycle insurance coverage. Learn We will attempt to honor the settings for most popular browsers, however you. Where Can You Get a Motorcycle Insurance Quote Online? · GEICO: GEICO has higher rates than some policies but lower rates than others. · Dairyland: Dairyland has. Motorcycle insurance can help protect you and your motorcycle. Get a fast and free motorcycle insurance quote to explore your options with Allstate. Start saving with VOOM's usage based insurance. by switching to VOOM Insurance, Rideshare, Delivery drivers and motorcycle riders can save up to 60%. Best Motorcycle Insurance of ; Best Overall: Progressive ; Best for Daily Commuters: Geico ; Best for Motorcycle Collectors: Foremost ; Best for Custom Bike. reviews. We only partner with the top-rated motorcycle insurance companies in California to ensure that you get the best coverage options and at the lowest. best motorcycle insurance or the cheapest motorcycle insurance. We've put Compare Quotes From Top-Rated Insurance Companies. Zip Code Please enter a. 1 Answer Insurance · · 1, reviews ; Devitt · · 24, reviews ; Bennetts · · 13, reviews ; Wiserchoice · · reviews. Motorcycle Insurance in Mountain View, CA ; Nationwide Insurance. out of 5 rating3, Reviews ; Farmers Insurance. out of 5 rating1, Reviews ; State. Farmers is the smart choice for motorcycle insurance coverage. Learn We will attempt to honor the settings for most popular browsers, however you. Where Can You Get a Motorcycle Insurance Quote Online? · GEICO: GEICO has higher rates than some policies but lower rates than others. · Dairyland: Dairyland has.

We here at Accurate Auto Insurance value the longstanding associations we have built with the top-rated motorcycle insurance carriers, allowing us to provide. Mexpro offers the best Mexican Motorcycle insurance Coverage is provided by "Excellent" or "Good" A.M. Best rated motorcycle insurance companies who are. Acuity offers comprehensive motorcycle insurance We're rated A+. Only commercial regional insurer to be rated A+ by both AM Best and Standard & Poor's, making. For more than 50 years, Dairyland – a leading motorcycle insurance provider** – has offered competitive rates and quality coverage. Dairyland stands behind its. We can help you find affordable motorcycle insurance rates and great coverage no matter what type of bike you have. JD Power ranked Intact insurance based on customer satisfaction as the seventh best insurance company in Alberta with 2 stars, second in. Get the motorcycle insurance coverage you need at USAA Insurance Agency Review what else is available through the USAA Insurance Agency. hour. There are many factors (known as “rating factors”) that go into determining motorcycle insurance costs. These factors are specific to you. For example: How. We have several A+ rated insurance carriers we can shop with, to make sure you get the very best Motorbike Insurance and the lowest premiums. Ride with affordable and personalized motorcycle insurance from the #1 motorcycle We didn't become the best motorcycle insurance company by only giving our. Compare and evaluate the cheapest motorcycle insurance in New Jersey. Rankings are based exclusively on ratings and reviews from customers like you. The skilled agents at Southern Insurance Group are here to help you find the best motorcycle insurance policy for your needs. rated companies. The skilled agents at Southern Insurance Group are here to help you find the best motorcycle insurance policy for your needs. rated companies. Ranked by Forbes. Named one of America's Best Insurance Companies by Forbes. icon. 12 Million Customers. Reliable, quality coverage for customers across Rider offers low motorcycle insurance rates, money-saving discounts, and comprehensive insurance packages. L.A. Insurance is one of the best motorcycle insurance companies. We provide broad coverage for every motorcycle rider at affordable prices without negotiating. coverage are recommended for your specific situation. dog car window. Virginia Farm Bureau Insurance Reviews. 14 years with Farm Bureau and the entire process. 1 Answer Insurance · · 1, reviews ; Devitt · · 24, reviews ; Bennetts · · 13, reviews ; Wiserchoice · · reviews. We have several A-plus-rated insurance carriers we can shop with, to make sure you get the very best Motorcycle Insurance and the lowest premiums.

Average Cost For Hvac Unit

The average cost of a new AC unit is $5,, but can range from $3, to $7, This price is for a central AC unit. Other types of air conditioning systems. Homeowners will face an average cost of about $7, to replace their HVAC system in Depending on the size of the units you need and the age of the other. On average, the cost can range from $3, to $7, This includes the price of the unit itself, which can be between $1, and $3,, and. How Much Does It Cost To Replace A Commercial HVAC Unit? The cost to replace your HVAC unit varies depending on the size and energy usage of the system, but. For central air conditioning installation, the average price homeowners report is around $4, Remember, to get an average, some people pay more or less than. The cost to replace both your furnace and your air conditioner at the same time ranges from $ to $+. These major factors will determine if it's. The average central AC unit cost is $5,, with most homeowners spending somewhere between $3, and $8, to have an HVAC professional install a central AC. The average cost for an air conditioner replacement in Chicago ranges from $5,$9, on the low-end, $9,$14, in the mid-range, and upwards of $15, A new HVAC system costs around $7,, on average, and prices typically fall between $5, and $12, Pricing includes HVAC system and labor costs. How we. The average cost of a new AC unit is $5,, but can range from $3, to $7, This price is for a central AC unit. Other types of air conditioning systems. Homeowners will face an average cost of about $7, to replace their HVAC system in Depending on the size of the units you need and the age of the other. On average, the cost can range from $3, to $7, This includes the price of the unit itself, which can be between $1, and $3,, and. How Much Does It Cost To Replace A Commercial HVAC Unit? The cost to replace your HVAC unit varies depending on the size and energy usage of the system, but. For central air conditioning installation, the average price homeowners report is around $4, Remember, to get an average, some people pay more or less than. The cost to replace both your furnace and your air conditioner at the same time ranges from $ to $+. These major factors will determine if it's. The average central AC unit cost is $5,, with most homeowners spending somewhere between $3, and $8, to have an HVAC professional install a central AC. The average cost for an air conditioner replacement in Chicago ranges from $5,$9, on the low-end, $9,$14, in the mid-range, and upwards of $15, A new HVAC system costs around $7,, on average, and prices typically fall between $5, and $12, Pricing includes HVAC system and labor costs. How we.

View AC unit costs and the cost for a new furnace The prices listed here reflect the national average costs of installing of a new HVAC system or unit. How Much Does it Cost to Install a Furnace in Atlanta, GA Live in the ATL area? It can cost anywhere from $1,$4, to install a new furnace. Here's an in. The national average to install a brand new central air conditioning unit is $5,, with the typical price tag range of $3, to $7, Central AC unit costs. Depending on system type, average HVAC installation costs could range from $ to more than $ We discuss cost factors and average prices. I got quotes ranging from $$ depending on brand/warranty for my smaller house. Got a nice American Standard variable speed furnace +. Typical HVAC Replacement Costs By Type · Ductless Mini Split: $5, - $14, · Standard Air Conditioner/Condenser: $4, - $12, · Heat Pump: $4, - $12, On average, consumers can expect to pay anywhere between $1, and $4, for a new central ac unit. Keep in mind: Those prices are for the actual AC unit. The average cost to install an air conditioner is between $3, and $5, uv lights. HVAC Unit Type. Central AC. Ductless Split AC. Electric Furnace. Gas Furnace ; Low Cost. $6, $3, $13, $6, ; High Cost. $9, $13, $13, How Much Does It Cost To Replace A Commercial HVAC Unit? The cost to replace your HVAC unit varies depending on the size and energy usage of the system, but. The average gas HVAC system price is going to average around $7,, offering high-quality heating but is pricier due to safety measures against carbon. Here are some HVAC maintenance costs to be aware of: · One-time maintenance calls average $99 and up for a standard tune-up for your AC unit, heat pump or gas. The average homeowner spends around $5, to install new air conditioning, but costs range from $3, to $7,, depending on the unit's size and type. The average cost to install a heating and air conditioning system in new home construction is $ Compare system types and prices. Totals - Cost To Install Air Conditioning, 1 EA, $6,, $8, Average Cost per Unit, $6,, $8, Pros. Edit, Print & Save this in Homewyse Lists. The average cost to install an air conditioner is between $3, and $5, uv lights. The cost to replace both your furnace and your air conditioner at the same time ranges from $ to $+. These major factors will determine if it's. HVAC Unit Type. Central AC. Ductless Split AC. Electric Furnace. Gas Furnace ; Low Cost. $6, $3, $13, $6, ; High Cost. $9, $13, $13, It also depends upon the type of system. Carrier air conditioners, for example, offer a variety of energy efficiency or SEER2* ratings, various types of comfort. On average, consumers can expect to pay anywhere between $1, and $4, for a new central ac unit. Keep in mind: Those prices are for the actual AC unit.

How Does A Home Building Loan Work

On some loans, no payments are due until the house is completed. Fees on construction loans are typically higher than on mortgages because the risks are greater. You (the borrower) do NOT get money in advance to pay for things, like the lot or supplies. (However, it is possible to get a separate loan to buy the lot - ask. A construction loan can be used to cover multiple costs associated with building a home, including land, labor, building permits, and materials. What does a construction loan include? · A construction loan includes an initial payment to purchase land. · If you already have a loan on a property, the first. Construction loans are a short-term product, which means that when you secure one of these loans, you'll normally have that loan for a maximum of one year. A construction loan finances the building of your new home. As your home nears completion, you'll apply for a permanent mortgage that will be used to pay off. A construction mortgage is a type of loan that only pays for the building of a home. During the building phase, the loan money is often paid out in small. The buyer does have to re-qualify for the mortgage once building is complete. Additionally, with a two-step home construction loan, though only interest is due. A construction mortgage, also known as a builder mortgage, is a loan provided by a lender that allows the borrower to receive financing to build a new home. The. On some loans, no payments are due until the house is completed. Fees on construction loans are typically higher than on mortgages because the risks are greater. You (the borrower) do NOT get money in advance to pay for things, like the lot or supplies. (However, it is possible to get a separate loan to buy the lot - ask. A construction loan can be used to cover multiple costs associated with building a home, including land, labor, building permits, and materials. What does a construction loan include? · A construction loan includes an initial payment to purchase land. · If you already have a loan on a property, the first. Construction loans are a short-term product, which means that when you secure one of these loans, you'll normally have that loan for a maximum of one year. A construction loan finances the building of your new home. As your home nears completion, you'll apply for a permanent mortgage that will be used to pay off. A construction mortgage is a type of loan that only pays for the building of a home. During the building phase, the loan money is often paid out in small. The buyer does have to re-qualify for the mortgage once building is complete. Additionally, with a two-step home construction loan, though only interest is due. A construction mortgage, also known as a builder mortgage, is a loan provided by a lender that allows the borrower to receive financing to build a new home. The.

The basic idea of how a construction loan works is fairly straightforward. You apply for this type of loan when you are ready to begin building a home, and you. How do construction loans typically work? Construction loans are typically short term with a maximum of one year and they may have variable rates that move. A construction loan is an agreement you make with a lender to provide you with the financing needed to build a residential property. Construction financing is a short term mortgage that is utilized to finance the construction of a real estate project. This gives you the ability to build. During the construction phase of the project, borrowers will typically make interest-only payments on the loan. The repayment of the loan usually takes place. Renovations to your current home as part of a mortgage refinance that includes your existing mortgage and construction costs. New home construction. Building. You'll only need to repay the interest on the amount that you've been advanced for the first 18 months of construction, or until the work on your home has been. You get a construction loan, which is a short-term loan you can use to finance the construction of a new home. During construction, you usually. A home equity loan is one of the most common ways to access the value you have stored in your property. Many traditional and alternative lenders can help you. A construction loan comes from a bank, not a mortgage company, because the bank likes to do short-term loans as opposed to the longer-term mortgage. The. The bank specifies a certain timeframe that your home needs to be completed in, usually 12 or 18 months. Should your project go over the bank's schedule, you'll. How Does a Construction Loan Work? Construction loans are short-term loans that are usually only intended to be used for a year. Following the completion of. When your house is complete, the lender will inspect your home and convert your construction loan to a standard home loan. Lenders typically allow you to pay. A construction-to-permanent loan can provide the funds needed to build your home while requiring interest-only payments only on the money you've withdrawn. This loan covers only the expenses incurred during the construction process. You will then need to secure a separate mortgage loan after the house is built. You. According to the Consumer Financial Protection Bureau, a construction loan provides the funding needed to build a home. Funds borrowed are typically released in. Unlike a lump sum loan, construction loans are similar to a line of credit, so interest is based only on the actual amount you borrow to complete each portion. This type of loan only covers the purchase of land or an existing building and the costs to build new or re-develop the existing property. Once the project is. Construction only loans provide financing exclusively for the construction phase of a home and must be paid in full upon completion. In contrast, construction-. The bank specifies a certain timeframe that your home needs to be completed in, usually 12 or 18 months. Should your project go over the bank's schedule, you'll.

Best Insurance Policy In India

Buy/Renew health insurance plans in india, medical insurance policy with Niva Bupa that covers COVID, + Cashless Hospitals and Tax Benefits. There are different types of life insurance policies in India. One can choose a life insurance plan based on their unique individual requirements. Top 10 Life Insurance Policies · Aditya Birla Sun Life Insurance · SBI Life eShield · HDFC Life Click 2 Protect Plus · Aviva i-Life · Future Generali Care Plus. It can be difficult to choose the finest life insurance policy in India because various life insurance providers have many available options. India's best Government health insurance companies which offer comprehensive and competitive health coverage. Get a Quote: Affordable Family Health Insurance Plan from Niva Bupa. Cover hospitalization, surgery, critical illness & more. Find the right plan for your. Outside of the top 5 we also have a few honorable mentions including: · ICICI Lombard Health AdvantEdge · Acko Platinum Health Plan · Star Health Assure · HDFC. Term Insurance: Buy best term insurance in India at just ₹21/day and 7% discount online. Get a term insurance plan cover of ₹1 crore along with zero cost. Our Best-Selling Life Insurance Plans · Popular Term Insurance Plans · Sampoorna Raksha Promise · Maha Raksha Supreme Select · Popular Guaranteed Return Plans. Buy/Renew health insurance plans in india, medical insurance policy with Niva Bupa that covers COVID, + Cashless Hospitals and Tax Benefits. There are different types of life insurance policies in India. One can choose a life insurance plan based on their unique individual requirements. Top 10 Life Insurance Policies · Aditya Birla Sun Life Insurance · SBI Life eShield · HDFC Life Click 2 Protect Plus · Aviva i-Life · Future Generali Care Plus. It can be difficult to choose the finest life insurance policy in India because various life insurance providers have many available options. India's best Government health insurance companies which offer comprehensive and competitive health coverage. Get a Quote: Affordable Family Health Insurance Plan from Niva Bupa. Cover hospitalization, surgery, critical illness & more. Find the right plan for your. Outside of the top 5 we also have a few honorable mentions including: · ICICI Lombard Health AdvantEdge · Acko Platinum Health Plan · Star Health Assure · HDFC. Term Insurance: Buy best term insurance in India at just ₹21/day and 7% discount online. Get a term insurance plan cover of ₹1 crore along with zero cost. Our Best-Selling Life Insurance Plans · Popular Term Insurance Plans · Sampoorna Raksha Promise · Maha Raksha Supreme Select · Popular Guaranteed Return Plans.

LIC's Insurance Plans are policies that talk to you individually and give you the most suitable options that can fit your requirement. Get a Quote: Affordable Family Health Insurance Plan from Niva Bupa. Cover hospitalization, surgery, critical illness & more. Find the right plan for your. Best Health Insurance in India for Expats or Foreigners. For all foreign nationals living in India, we recommend the Cigna Global plan as it offers. Insurance: Best Insurance Policy in India. Get information about Life Insurance, Car Insurance, Health Insurance, Travel Insurance, Home insurance. List of Top Health Insurance Plans · Aditya Birla Activ Fit Health Insurance: Best Health Insurance Plan for Individuals · STAR Health's Senior Citizens Red. Discover Kotak Life Insurance's range of life insurance plans online. Compare and buy the best life insurance policy for , ensuring comprehensive. I did my research, ICICI Lombard and HDFC ERGO has the highest premiums, Reliance General insurance has low premium. Health Insurance Plans - Buy Health Insurance Online in India at an affordable price. ICICI Prulife Health insurance policy covers medical expenses. Protect yourself and your family against all risks with our Online Insurance Plans and get the policy instantly here with just a few clicks. ACKO Platinum Health Plan This is India's top-ranking health insurance plan which gives amazing benefits. For example, coverage from day 01, zero deductions on. Best Health Insurance Plans to secure yourself · Star Women Care Insurance Policy · Star Comprehensive Insurance Policy · Senior Citizens Red Carpet Health. Although all kinds of life insurance serve different purposes, Term Insurance is said to be the best form of life insurance. Is short term life insurance. Find the best health insurance companies in India and choose the one from our list of health insurers that offers comprehensive coverage to you and your. We at HDFC ERGO are committed to making your life easier with our services, settling one claim every minute*. Our range of health insurance plans has brought. A life insurance policy helps you safeguard the financial interests of your family when you are not around. Discover an insurance plan that is right for you · What are the benefits of having a Personal Accident policy? This policy provides your beneficiary with a death. Compare Best mediclaim insurance ; (Dental/Ophthal coverage in a block of 3 years of continuous renewal, -, - ; OPD Medical Consultation (other than OPD. Term Insurance: Buy India's best term insurance plan at just ₹ per month with ₹1 crore cover,12% discount, and best claims settlement ratio of %. Term Insurance: Buy India's best term insurance plan at just ₹ per month with ₹1 crore cover,12% discount, and best claims settlement ratio of %.

Mutual Fund Financial Advisor

As a mutual fund dealer, SLFISI offers a range of mutual fund products from some of the leading investment fund managers in Canada. Financial advisors often place certain mutual funds with elevated expense ratios in client accounts. The reason for this is often simple: this practice can. Mutual funds pay financial advisors ongoing trailer fees, ranging from % to 1% per year of the amount invested. The fees are intended to motivate financial. Mutual Funds · American Century Investments · American Funds · Invesco · Fidelity Advisor Funds · Franklin Templeton Investments · MFS Investment Management · Nuveen. As an advice client, your financial journey drives the diversified blend of ETFs (exchange-traded funds) and mutual funds included in your portfolio—regardless. The Mutual Fund Dealers Association, which regulates firms and advisors that sell mutual funds; · The Investment Industry Regulatory Association of Canada, which. Financial Advisors at banks do not get commission for selling products, including mutual funds. They get paid a salary. Russell Investments offers investment solutions, including top-ranked model portfolios and mutual funds, which are designed to improve investors' financial. A mutual-fund advisory program, also known as a mutual fund wrap, is a portfolio of mutual funds that are selected to match a pre-set asset allocation. As a mutual fund dealer, SLFISI offers a range of mutual fund products from some of the leading investment fund managers in Canada. Financial advisors often place certain mutual funds with elevated expense ratios in client accounts. The reason for this is often simple: this practice can. Mutual funds pay financial advisors ongoing trailer fees, ranging from % to 1% per year of the amount invested. The fees are intended to motivate financial. Mutual Funds · American Century Investments · American Funds · Invesco · Fidelity Advisor Funds · Franklin Templeton Investments · MFS Investment Management · Nuveen. As an advice client, your financial journey drives the diversified blend of ETFs (exchange-traded funds) and mutual funds included in your portfolio—regardless. The Mutual Fund Dealers Association, which regulates firms and advisors that sell mutual funds; · The Investment Industry Regulatory Association of Canada, which. Financial Advisors at banks do not get commission for selling products, including mutual funds. They get paid a salary. Russell Investments offers investment solutions, including top-ranked model portfolios and mutual funds, which are designed to improve investors' financial. A mutual-fund advisory program, also known as a mutual fund wrap, is a portfolio of mutual funds that are selected to match a pre-set asset allocation.

Fidelity Institutional helps advisors, financial professionals, and Fidelity Advisor Mutual Funds · Fidelity Mutual Funds · Fidelity ETFs · Fidelity. Diversify your portfolio with a broad mix of investments. We review the universe of stocks, bonds and mutual funds to select quality options for you. Advisor Mutual Fund Program · At a glance · Provide your clients with the diversification of multiple investment companies without the hassle of opening a. An investment adviser is an individual or company who is paid for providing advice about securities to their clients. The term investment adviser refers to. Your Edward Jones financial advisor can help you determine your investment goals, risk tolerance and time horizon, and recommend a fund that is suitable. Ask. Funds that match up with investing goals and preferences. Each investor has a different story, and we are steadfast partners to our clients in the US because we. Investment products · Stocks, bonds and mutual funds · Stocks · Fixed Income Investments · Current rates · Mutual funds · Exchange Traded Funds · Financial Advisor. The Company provides securities brokerage, investment banking, trading, investment advisory Contact a Stifel Financial Advisor to learn more. Important. They may use a variety of titles, such as investment advisor or financial advisor, financial planner, investment consultant or investment specialist. A growing segment of the investment market, mutual funds are professionally managed portfolios whose shares are sold to the public in much the same way that. Financial planners offer advice and guidance covering the complete personal financial spectrum, including saving and investing, insurance, retirement and. PGIM offers actively managed strategies and investment solutions, through mutual funds, ETFs, and separately managed accounts. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Consider the investment objectives, risks, and. Mutual Fund & accounts. Leave the BlackRock site for Individuals to explore other content. Advisors. I invest on behalf of my clients. Institutions. I. Financial Advisors should have technical knowledge about at least one common investment product, including: mutual funds, stocks, bonds, or Exchange-Traded. The best source of information about specific mutual funds is the investor prospectus prepared by the mutual fund company which your Janney Financial Advisor. Putnam's portfolio managers and investment professionals offer their latest insights and take your questions about the markets and Putnam funds. Don't use Mutual Funds. The best asset managers walked away from mutual funds long ago, especially because they are tax inefficient. Most of them are now using. Component Text The fund seeks to achieve long-term capital appreciation through investment in large market capitalization companies that have durable. A financial advisor can help build assets for a more comfortable retirement, maintain a long-term investment strategy, and avoid emotional investing habits.

Transfer From Coinbase To Another Wallet

Transfer crypto to your Coinbase Wallet from another wallet · Select Send · Select the asset you'd like to transfer, and enter an amount · Enter the address of the. In Exodus Mobile, a) tap the Wallet icon. Scroll or search to find the asset you're sending, and b) tap on it. In this guide, we'll break down everything you need to know to move your cryptocurrency from Coinbase to the external wallet of your choice. Select the amount of ETH you would like to send to your Coinbase account · Confirm the transaction. It should take a few minutes for the transfer to complete. # Restore your Trust Wallet via Web Wallet · Login to your Coinbase account. · Select the “Send” button. · Choose the asset and the amount you want. Note that the period during which you held the crypto begins on the day after you acquired it and ends on the day you send it. Quentin sent 1 Bitcoin to. I know a personal wallet is safer than Coinbase, but which wallet should I buy? And how does the process work transferring Bitcoin from Coinbase to a Wallet? First, sign in to your Coinbase account and tap Send. Tap the asset you would like to send to your Exodus wallet. Once you have the wallet address, you just need to open your crypto wallet, enter the wallet address, select how much crypto you want to send, and you're done. Transfer crypto to your Coinbase Wallet from another wallet · Select Send · Select the asset you'd like to transfer, and enter an amount · Enter the address of the. In Exodus Mobile, a) tap the Wallet icon. Scroll or search to find the asset you're sending, and b) tap on it. In this guide, we'll break down everything you need to know to move your cryptocurrency from Coinbase to the external wallet of your choice. Select the amount of ETH you would like to send to your Coinbase account · Confirm the transaction. It should take a few minutes for the transfer to complete. # Restore your Trust Wallet via Web Wallet · Login to your Coinbase account. · Select the “Send” button. · Choose the asset and the amount you want. Note that the period during which you held the crypto begins on the day after you acquired it and ends on the day you send it. Quentin sent 1 Bitcoin to. I know a personal wallet is safer than Coinbase, but which wallet should I buy? And how does the process work transferring Bitcoin from Coinbase to a Wallet? First, sign in to your Coinbase account and tap Send. Tap the asset you would like to send to your Exodus wallet. Once you have the wallet address, you just need to open your crypto wallet, enter the wallet address, select how much crypto you want to send, and you're done.

➡️Log in to your Coinbase account. ➡️Go to the “Send/Receive” section. ➡️Select the cryptocurrency you wish to transfer (Ethereum in this example). The procedure to transfer money from a Coinbase account and wallet is simple. First, go to your wallet and select an amount you want to withdraw. 1. Open your MetaMask extension, then copy your public wallet address. 2. Log in to your Coinbase account on desktop. 3. Click the button labeled 'Send &. Login to your MoonPay account. · Select the crypto asset wallet card you want to send. · Click the send icon (⮞). · Specify the amount and the recipient's wallet. From the asset page, under Trading Balance, click Deposit. Click Transfer Funds Internally. Select the portfolio and wallet you'll be transferring from. Select. Note that the period during which you held the crypto begins on the day after you acquired it and ends on the day you send it. Quentin sent 1 Bitcoin to. Scan the QR code using Trust Wallet on your phone. Step 4: All done! Your Coinbase Wallet extension is now funded with some crypto. Send crypto from another. Yes, you can transfer your bitcoins from Coinbase to a different wallet if you wish to securely store your digital assets in a private wallet. Before you can transfer from Coinbase to a Metamask wallet, you need to create an account on the Coinbase website or the Coinbase app. These steps will show you. The main difference between Coinbase exchange and Coinbase Wallet is that Coinbase is a custodial crypto exchange, while Coinbase Wallet is a non-custodial. 1. Open the Coinbase Wallet app on your mobile device. · 2. Tap on the "Send" button. · 3. Enter the Bitcoin address of the converter platform. From the Coinbase Wallet home screen, select Send. You'll be prompted to select the asset you'd like to use and to choose a desired amount. Initiate the Transfer from Coinbase · Click the “Accounts” button at the top of the page to see a list of all of your wallets. · Click on “BTC Wallet” and press“. To send your holdings from the CoinStats wallet to another wallet address, navigate to your Wallet tab, tap on the Send button located at the top left of your. How to send crypto · Go to the crypto's detail page · Enter the amount you'd like to send · Paste the crypto address of the receiving wallet. You can use Coinbase Wallet to send and receive supported cryptocurrencies and digital assets such as ERC tokens. Coinbase Wallet supports the following. Transferring Bitcoin to another wallet works much like sending Bitcoin to another user. Simply generate a public key address for the receiving wallet and send. To send your holdings from the CoinStats wallet to another wallet address, navigate to your Wallet tab, tap on the Send button located at the top left of your. Go to the Finances tab. · Tap your crypto balance. · Tap the · Tap Receive. · Choose which coin you want to receive, for example, BTC · Your QR code & Bitcoin. If you do not have an existing account, select "Sign up for Coinbase" and follow the instructions to create a new account. Step 2: Once your Coinbase account is.

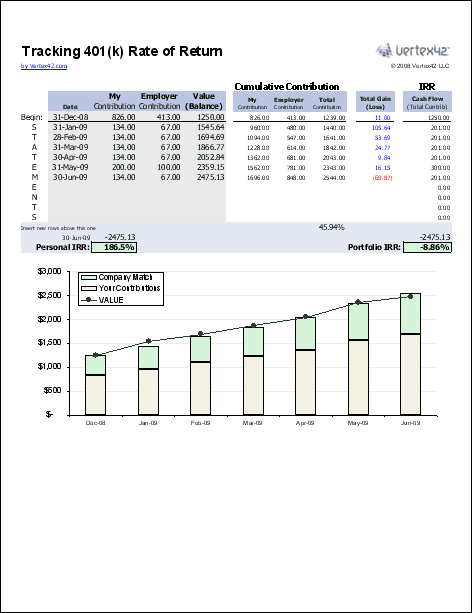

Calculate 401k Balance

By saving even a small percentage of your salary, you may be surprised to see just how much your (k) balance can grow. Our (k) calculator can help. (k) Employee Savings Plan: ; Percent to contribute · Enter an amount between 0% and % · 0% ; Annual salary · Enter an amount between $0 and $1,, · $0. Estimate your balance at retirement with this free (k) calculator. Input your monthly contributions and employer match information to see how your money. So if you retire at age 65, your last contribution occurs when you are actually Current (k) balance: The starting balance or current amount you have. This calculator simplifies the intricate details of retirement planning into easy-to-understand insights that help you prepare for the future without the. Current (k) Balance: $ ; Your Annual Contribution: $ ; Employer's Matching Contribution: $ ; Years to Retirement: ; Investment Return Rate: %. Use SmartAsset's (k) calculator to figure out how your income, employer matches, taxes and other factors will affect how your (k) grows over time. Use this k Calculator to estimate your retirment income and on average. Investing thebalance ofmy retirementsavingsshould fetchan averagereturn of. Our (k) calculator can help you determine how much money you may be able to save by the time you retire. By saving even a small percentage of your salary, you may be surprised to see just how much your (k) balance can grow. Our (k) calculator can help. (k) Employee Savings Plan: ; Percent to contribute · Enter an amount between 0% and % · 0% ; Annual salary · Enter an amount between $0 and $1,, · $0. Estimate your balance at retirement with this free (k) calculator. Input your monthly contributions and employer match information to see how your money. So if you retire at age 65, your last contribution occurs when you are actually Current (k) balance: The starting balance or current amount you have. This calculator simplifies the intricate details of retirement planning into easy-to-understand insights that help you prepare for the future without the. Current (k) Balance: $ ; Your Annual Contribution: $ ; Employer's Matching Contribution: $ ; Years to Retirement: ; Investment Return Rate: %. Use SmartAsset's (k) calculator to figure out how your income, employer matches, taxes and other factors will affect how your (k) grows over time. Use this k Calculator to estimate your retirment income and on average. Investing thebalance ofmy retirementsavingsshould fetchan averagereturn of. Our (k) calculator can help you determine how much money you may be able to save by the time you retire.

Here's how that works: We take your estimated final balance at retirement and multiply it by to get your annual payout. Then, we divide that number by Calculate the costs and potential savings of setting up a (k) plan for your small business with Ubiquity's detailed calculator. Gain insights into tax. It may surprise you how significant your retirement accumulation may become simply by saving a small percentage of your salary each month in your (k). Discover the long-term impact of (k) fees on your retirement savings. Input your account details to see how compound interest and varying fee amounts. A (k) can be one of your best tools for creating a secure retirement. Click here to estimate your (k) balance by year using our online calculator! Are you saving enough money for retirement? Use our retirement savings calculator to help find out how much money you need to save for retirement. (k) Details →. Enter (k) savings to date, expected annual rate of return on investments, your annual (k) contribution (% of salary). Use this calculator to see how adding a small percentage of your salary each month could impact your total (k) savings at retirement. Individual (k) could be worth $1,, after 36 years. *indicates required. CALCULATE. Your Calculated Account Balance: $0. Your Estimated Account Balance with Professional Help*. $0. Do You See the Potential with (k) Maneuver? Would. savings account (HSA) calculator. The calculator will estimate your health care expenses and savings potential, allowing you to make informed decisions. Try out this (k) calculator. (k) calculator Estimate what your (k) will be worth when you retire. Use these free retirement calculators to determine how much to save for retirement, project savings, income, K, Roth IRA, and more. Federal tax withholding calculations · Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. · Subtract $12, for. Do not include investment earnings or the amount of any employer matches, if any. Also, do not enter the “account value” figure that is seen on your (k). How To Easily Calculate Your k Investment Savings Growth For Retirement ; Enter total monthly contributions (yours, employer match, catch-up): ; Enter. Use our (k) calculator to plan and estimate your retirement savings and see if you are saving enough to meet your goals, including employer match. This calculator assumes that the year you retire, you do not make any contributions to your (k). Use our (k) calculator to estimate how much you will have saved for retirement based on your current retirement savings plan. Everyone deserves access to a secure financial future. That's why we make it easy for employers to offer a (k) to their team. No matter where your employees.

Current Td Ameritrade Promotions

TD Ameritrade Brokerage or Retirement Account Promotion: Up to $2, Cash Bonus · Cash Value: Up to $2,, depending on the amount you deposit. · Availability. Value is based on over 70% of current Aeroplan cardholders receive a value of $/points or more when redeeming for a flight as of Feb 1, Redemption. Save at TD Ameritrade with top coupons & promo codes verified by our experts. Choose the best offers & deals for August ! TD Ameritrade Discussions. Discussions Topics: All, Benefits, Culture, Interview, Layoffs, Promotion, PTO, Salary. TD Ameritrade Review. TD Ameritrade's recent move to commission-free trading has boosted the platform's popularity. See if the brokerage has what you need in. claim limited welcome rewards! Open In App >. Help Center /; Promotions /; Current TD Ameritrade (including ThinkorSwim), Interactive Brokers, Fidelity, E. During TD Ameritrade Father's Day sales, you can expect discounts ranging from 10% to 50% on a variety of products. Be sure to check the TD Ameritrade website. Or are current tda clients disqualified from any new schwab account promo TD Ameritrade Financial services Financial sector Business Business. Discover the TD Client Rewards Card, get % cash back on everything, no fee and get 10% bonus when you redeem rewards to your TD Ameritrade account. TD Ameritrade Brokerage or Retirement Account Promotion: Up to $2, Cash Bonus · Cash Value: Up to $2,, depending on the amount you deposit. · Availability. Value is based on over 70% of current Aeroplan cardholders receive a value of $/points or more when redeeming for a flight as of Feb 1, Redemption. Save at TD Ameritrade with top coupons & promo codes verified by our experts. Choose the best offers & deals for August ! TD Ameritrade Discussions. Discussions Topics: All, Benefits, Culture, Interview, Layoffs, Promotion, PTO, Salary. TD Ameritrade Review. TD Ameritrade's recent move to commission-free trading has boosted the platform's popularity. See if the brokerage has what you need in. claim limited welcome rewards! Open In App >. Help Center /; Promotions /; Current TD Ameritrade (including ThinkorSwim), Interactive Brokers, Fidelity, E. During TD Ameritrade Father's Day sales, you can expect discounts ranging from 10% to 50% on a variety of products. Be sure to check the TD Ameritrade website. Or are current tda clients disqualified from any new schwab account promo TD Ameritrade Financial services Financial sector Business Business. Discover the TD Client Rewards Card, get % cash back on everything, no fee and get 10% bonus when you redeem rewards to your TD Ameritrade account.

The free cash bonus is constantly changing, and no one can really tell you what TD Ameritrade will offer next. You can wait and keep checking for new promos as. TD Ameritrade Deals & Coupons · Apple iPad 64GB " Retina WiFi Tablet (9th Gen) $ · Samsung Galaxy Z Fold6 Unlocked Smartphone Deals: Up to $ Instant. TD Securities (USA) LLC, TD Prime Services LLC, and TD present you with relevant ads and offers on our apps and sites and on third party apps and websites. Your TD Ameritrade Client Rewards VISA® Card account (“Account You also may telephone Customer Service for your current credit limit. Current TD Ameritrade promotion offer for $ and $1, September best TD Ameritrade promotion for opening a new account or for existing customers. Promotions for Macbooks Plus Other Ways To profile Joel Koh. ○. 49mth ago I'm currently using FSMone to invest in US stocks. Should i switch over. Use our top September TD Ameritrade coupon codes: Current special offers at TD A Promotions 2; Printables 0; In-Store 0. SALE. Current Special. These assets are currently with TD Ameritrade. I'm thinking of moving to M1 for the $10K transfer bonus. It almost sounds way too good to be. TD Securities is a leading investment bank that provides corporate and investment banking and capital markets products and services to corporate. TD Ameritrade is currently offering 20 total coupons for discounts on their website. Today's best TD Ameritrade coupon is for 20% off. How often does TD. Open and fund a new TD Bank investing account by April 30, , and you'll get up to $ in bonus cash. This offer applies to TD Bank Automated Investing, its. 4 active coupon codes for TD Ameritrade in September Save with narxoz.ru discount codes. Get 30% off, 50% off, $25 off, free shipping and cash. TD Ameritrade, Inc. ("Ameritrade") Member SIPC, a subsidiary of The Charles Currently, only the following states regulate the offer and sale of. Double up and cash in. Earn a sweet $ bonus and unlimited 2% Cash Back with TD Double narxoz.ru Learn. Whether you're leaving Robinhood, M1 Finance, WeBull, Charles Schwab, TD Ameritrade If your current brokerage charges you on the way out, we'll even. I have forwarded a request to the associate on the promotions team to present your case to Marketing who processed my request last week. I should receive. User reports indicate no current problems at TD Ameritrade. TD Ameritrade is Downdetector app promotion. TD Ameritrade comments Tips? Frustrations. Plus, get additional S$ if you transfer from TD Ameritrade. T&Cs apply. Redeem now. Refer a friendRefer your friends to CMC Invest using your unique. Make a qualifying net deposit of cash or securities within 45 days of opening the account. We'll deposit the Bonus Award into your account about a week after. Valid points. I'm sure some sort of promotion will come back later, as they currently have nothing to offer to compete with the amazing offers that Fidelity has.